Investing for Beginners: A 2025 Guide to Building Your Portfolio

Investing for beginners in 2025 requires understanding personal finance and building a diversified portfolio; this guide offers key strategies for those new to investing.

Embarking on your investment journey can seem daunting, especially if you’re just starting out. But with the right knowledge and a solid plan, anyone can build a diversified portfolio and achieve their financial goals. Are you ready to take control of your financial future?

This guide, investing for beginners: A personal finance guide to building a diversified portfolio in 2025, will provide you with the essential steps and strategies to start investing confidently. Whether you’re saving for retirement, a down payment on a house, or simply want to grow your wealth, understanding the basics of investing is crucial.

Understanding the Basics of Investing

Before diving into the specifics, it’s essential to grasp the fundamental concepts of investing. This involves understanding different asset classes, risk tolerance, and the importance of diversification. Let’s break down these key elements.

What are Asset Classes?

Asset classes are categories of investments that share similar characteristics and behave similarly in the market. Common asset classes include stocks, bonds, and real estate.

Determining Your Risk Tolerance

Risk tolerance is your ability and willingness to lose money in exchange for potentially higher returns. Understanding your risk tolerance is crucial for choosing investments that align with your comfort level.

- Conservative: Prefers low-risk investments, such as bonds and CDs.

- Moderate: Seeks a balance between risk and return, often investing in a mix of stocks and bonds.

- Aggressive: Comfortable with higher risk for the potential of higher returns, focusing on stocks and growth investments.

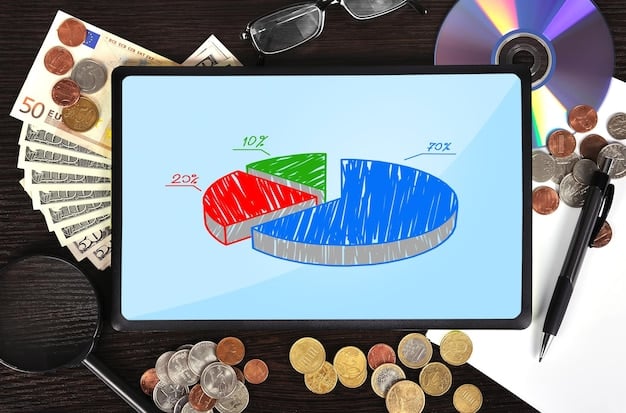

Diversification is the practice of spreading your investments across different asset classes and industries to reduce risk. By diversifying, you minimize the impact of any single investment performing poorly.

In this section, we’ve covered the basics: understanding asset classes, determining your risk tolerance, and the importance of diversification. These concepts form the foundation for making informed investment decisions.

Setting Financial Goals and Creating a Budget

Effective investing starts with clear financial goals and a well-defined budget. This step involves identifying what you want to achieve with your investments and creating a plan to allocate your resources accordingly. Understanding these elements is critical as you start investing for beginners: A personal finance guide to building a diversified portfolio in 2025.

Defining Your Financial Goals

Financial goals can range from short-term objectives like saving for a vacation to long-term goals such as retirement. Clearly defining your goals helps you prioritize your investments.

Creating a Realistic Budget

A budget is a roadmap for your money, outlining where your income comes from and where it goes. Creating a budget helps you identify how much you can realistically invest.

- Track Your Expenses: Use budgeting apps or spreadsheets to monitor your spending habits.

- Set Savings Targets: Allocate a portion of your income to savings and investments each month.

- Review and Adjust: Regularly review your budget and adjust it as your financial situation changes.

By setting clear financial goals and creating a realistic budget, you’ll have a solid foundation for investing for beginners: A personal finance guide to building a diversified portfolio in 2025. This proactive approach ensures that your investment decisions align with your overall financial objectives.

Exploring Investment Options

With the basics covered, let’s explore the various investment options available to beginners. This section will cover stocks, bonds, mutual funds, and ETFs, providing a clear understanding of each.

Stocks: Ownership in a Company

Stocks represent ownership in a company, and their value can fluctuate based on market conditions and company performance. Be cautios while investing for beginners: A personal finance guide to building a diversified portfolio in 2025.

Bonds: Lending to a Government or Corporation

Bonds are debt instruments where you lend money to a government or corporation in exchange for periodic interest payments. Bonds are generally considered less risky than stocks.

Mutual Funds: Diversified Portfolio Managed by Professionals

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Professional managers oversee these funds.

ETFs, or Exchange-Traded Funds, are similar to mutual funds but trade like stocks on an exchange. They offer diversification and can be more cost-effective than mutual funds.

Understanding these investment options – stocks, bonds, mutual funds, and ETFs – is crucial for investing for beginners: A personal finance guide to building a diversified portfolio in 2025. Each offers unique benefits and risks, so choose wisely based on your financial goals and risk tolerance.

Strategies for Building a Diversified Portfolio

Building a diversified portfolio is key to managing risk and maximizing returns. This section outlines strategies for allocating your investments across different asset classes.

Asset Allocation: Balancing Risk and Return

Asset allocation involves dividing your investment portfolio among different asset classes, such as stocks, bonds, and real estate, based on your risk tolerance and financial goals.

Rebalancing Your Portfolio

Over time, your portfolio’s asset allocation may drift due to market fluctuations. Rebalancing involves selling some assets and buying others to restore your original allocation.

- Determine Your Target Allocation: Decide what percentage of your portfolio should be in stocks, bonds, and other assets.

- Monitor Your Portfolio: Track your portfolio’s performance and asset allocation regularly.

- Rebalance Periodically: Rebalance your portfolio at least annually or when your asset allocation deviates significantly from your target.

Investing for beginners: A personal finance guide to building a diversified portfolio in 2025 emphasizes the importance of building a well-diversified portfolio to mitigate risk and achieve long-term financial success. By carefully allocating and rebalancing your assets, you can create a resilient investment strategy.

Long-Term Investing Strategies

Investing is a long-term game, and adopting the right strategies can significantly impact your financial success. This section covers dollar-cost averaging and the importance of staying disciplined.

Dollar-Cost Averaging: Investing Regularly Over Time

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the risk of buying high and selling low.

Staying Disciplined and Avoiding Emotional Decisions

Emotional decision-making can be detrimental to your investment performance. Staying disciplined and sticking to your investment plan is crucial for long-term success.

- Ignore Short-Term Market Noise: Focus on the long-term potential of your investments rather than reacting to daily market fluctuations.

- Avoid Panic Selling: Resist the urge to sell your investments during market downturns.

- Stay Consistent: Continue investing regularly, even when the market is volatile.

The principles of investing for beginners: A personal finance guide to building a diversified portfolio in 2025 highlight the value of long-term strategies like dollar-cost averaging and disciplined decision-making. These approaches help you navigate market volatility and build wealth over time.

| Key Aspect | Brief Description |

|---|---|

| 🎯 Setting Goals | Define clear, achievable financial goals to guide your investing strategy. |

| 💰 Diversification | Spread investments across various asset classes to reduce risk. |

| ⏱️ Long-Term View | Focus on long-term growth rather than short-term market fluctuations. |

| 📊 Rebalancing | Adjust asset allocation to maintain desired risk levels over time. |

Frequently Asked Questions

The first step is to define your financial goals and create a budget to understand how much you can realistically invest. This helps align your investments with your objectives.

The main asset classes include stocks, bonds, and real estate. Each has different risk levels and potential returns, so diversifying across these classes is essential.

Diversification is crucial because it helps reduce risk by spreading your investments across different assets and industries. This minimizes the impact of any single investment performing poorly.

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the risk of buying high.

You should rebalance your portfolio at least annually or when your asset allocation deviates significantly from your target. This ensures your portfolio remains aligned with your risk tolerance.

Conclusion

Starting your investment journey can be exciting and rewarding. By understanding the basics, setting clear goals, and adopting long-term strategies, investing for beginners: A personal finance guide to building a diversified portfolio in 2025 can transform your financial future.

Remember to stay disciplined, diversify your investments, and focus on your long-term goals. With patience and persistence, you can build a solid portfolio and achieve financial success.

“